Debt can feel overwhelming, especially when your income is limited. Nevertheless, with a solid plan, smart budgeting, and strategic changes, you can tackle financial challenges and pay off debt efficiently. In this post, we will explore practical steps and strategies to help you regain control. Moreover, these tips will enable you to accelerate your debt payoff journey.

Understand Your Financial Picture To Pay Off Debt

To begin, start by gathering your financial details—including debts, interest rates, monthly expenses, and income sources. Once you organize this information, you’ll gain a clearer picture of your situation, which will help you build a realistic plan. Furthermore, consider using budgeting tools or spreadsheets to track your spending and earnings. This approach allows you to identify areas for improvement and, consequently, take meaningful steps toward achieving financial stability.

Adopt a Detailed Budgeting Technique To Pay Off Debt

For low-income earners, every cent matters. Maximize your income with a zero-based budget, assigning each dollar a specific purpose. This method covers essential expenses and prioritizes debt repayment. To begin:

• List your expenses, separating essentials from non-essentials.

• Identify areas to cut wasteful spending and free up funds.

• Regularly update your budget as circumstances change.

By staying proactive, you can organize your finances and focus on reducing debt.

Prioritize Your Debts Strategically To Pay Off Debt

Managing debt starts with understanding your options. The debt avalanche method targets high-interest debts to save money long-term, while the snowball method clears smaller balances first to boost motivation. Limited income may warrant focusing on high-interest debts to minimize total interest, while paying off smaller debts can build confidence. Always make minimum payments on all debts and use extra funds to speed up progress.

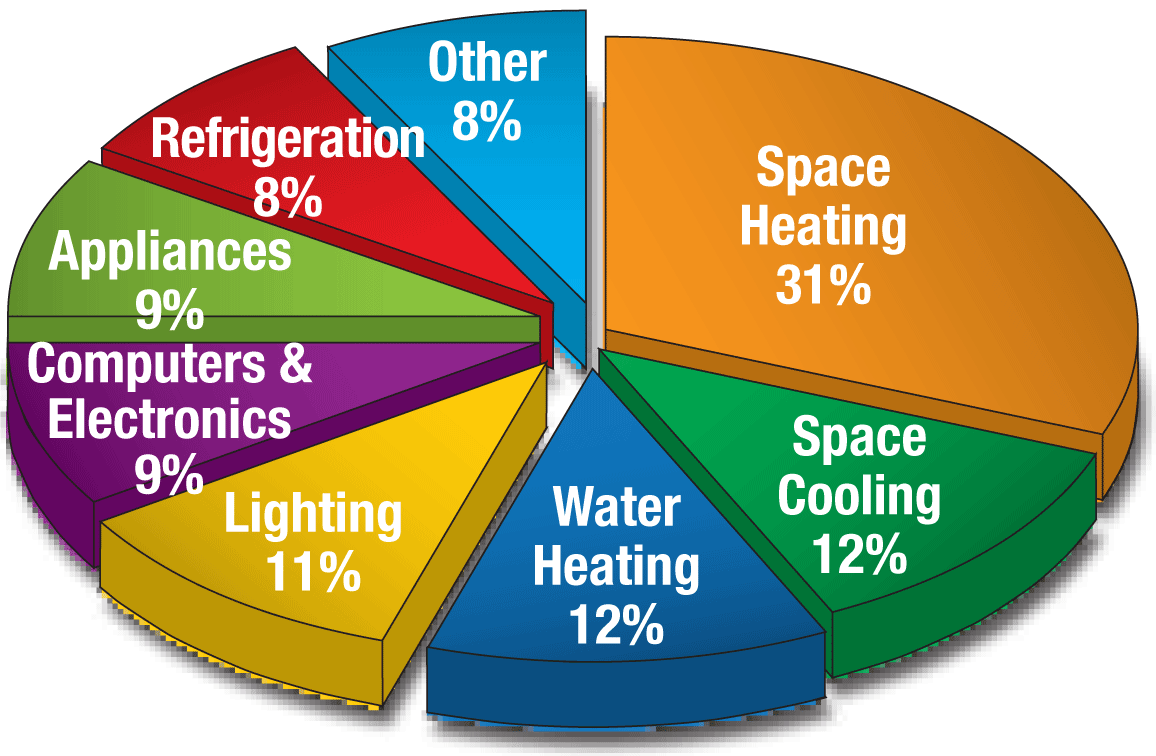

Reduce Expenses and Increase Income

When money is tight, finding ways to cut costs and boost income becomes essential. To begin with:

• First, consider eliminating unnecessary subscriptions or luxury expenses to free up funds.

• Next, shop smarter for essentials by taking advantage of sales, using coupons, or buying in bulk to save on everyday items.

• Additionally, explore side gigs or freelance work—just a few extra hours weekly can lead to meaningful earnings.

• Finally, consider financing options cautiously, ensuring affordable terms while avoiding debt for everyday expenses, as high interest can quickly erode financial progress.

Use “Other People’s Money” – Wisely

Sometimes, using financing options for income-generating investments can be a strategic move. For example, financing a business expense or advertising package that boosts income streams could be advantageous. However, it’s essential to assess risks and ensure the potential income far exceeds the debt.

Track Your Progress and Adjust

Begin with, commit to your debt payoff strategy and make it a habit to regularly track your progress. Furthermore, celebrate small victories—each cleared debt represents an essential step toward financial freedom. However, if challenges arise, take time to reassess and adjust your budget or priorities. Ultimately, staying adaptable ensures steady progress, even in the face of setbacks.

Stay Motivated and Seek Support

Paying off debt on a limited income is more like a marathon than a sprint. Stay motivated by setting short-term, achievable goals. If feeling overwhelmed, seek help from financial counselors or support communities. Even a quick conversation can provide new insights and boost your determination to become debt-free.

Conclusion

Paying off debt quickly is possible with smart strategies and careful planning. Start by understanding your finances and creating a budget to evaluate your situation. Prioritize your debts to focus on the most urgent ones. Cutting expenses and increasing income will help you progress steadily. Every effort counts, and with persistence, financial freedom is within reach.

Leave a Reply