How To Improve Your Financial Situation

Enhancing your financial situation begins with intentional planning and disciplined execution. Here are actionable steps to take:

• Build a realistic budget to monitor your income and expenses effectively.

• Cut back on unnecessary spending and focus on essentials.

• Increase your savings by setting clear goals and automating deposits.

• Explore opportunities for additional income, such as freelance work or side hustles.

• Educate yourself on financial literacy to make smarter investment decisions.

Taking control of your finances not only reduces stress but also paves the way for long-term stability and wealth accumulation.

Financial security isn’t about overnight success. It’s about small, consistent steps that move you toward long-term stability and prosperity. Whether you’re just starting your journey or looking for ways to enhance your current situation, here are some proven strategies to improve your financial situation.

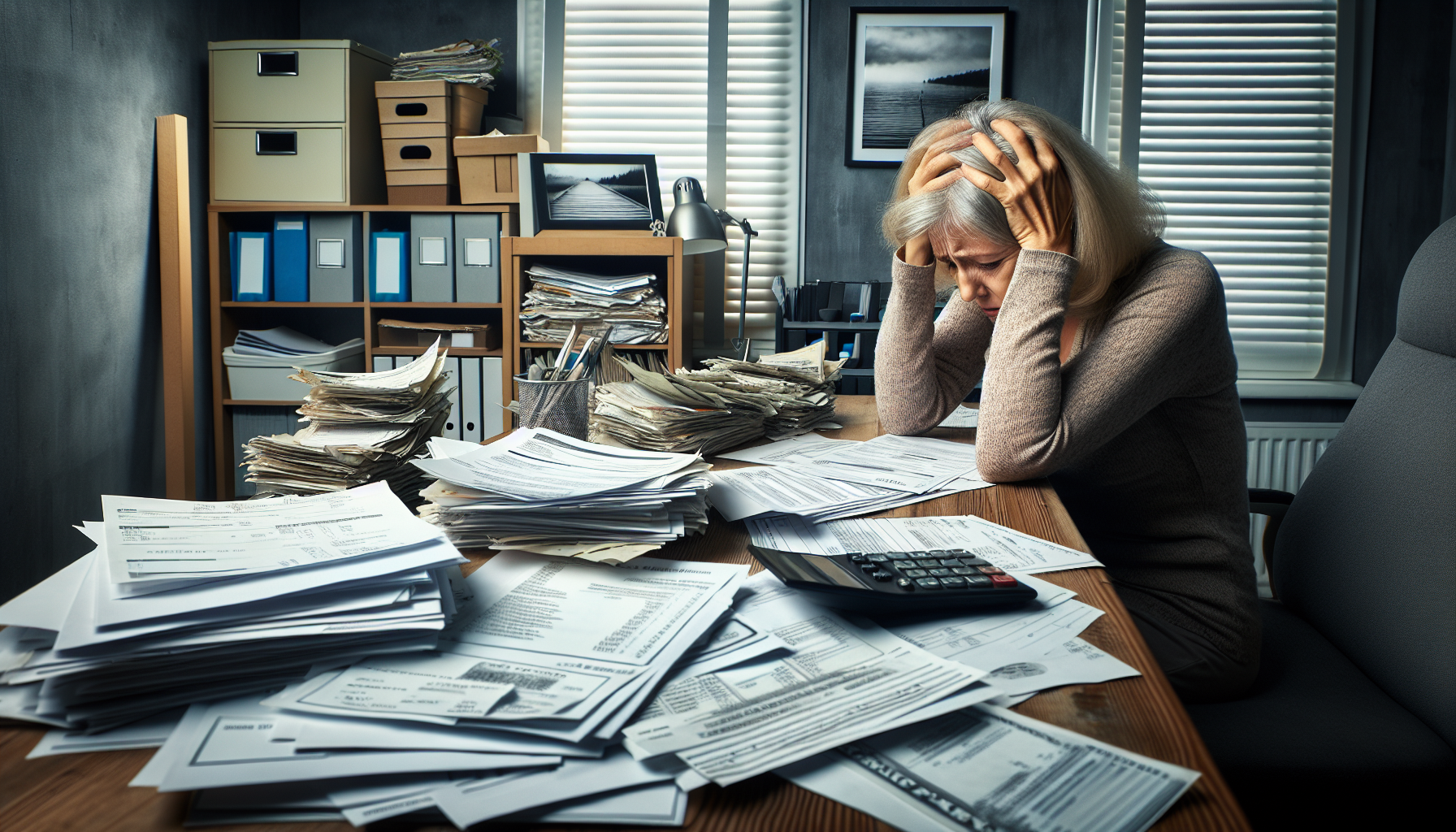

Create a Strong Budget to Improve Your Financial Health

Creating a budget is the cornerstone of financial success. It helps you understand where your money is going and where you can make adjustments.

• List your income and all monthly expenses.

• Identify non-essential expenses that you can reduce or eliminate.

• Set spending limits and track your progress regularly.

A well-crafted budget doesn’t limit you—it empowers you to make informed financial decisions and frees up resources for savings and investments.

- Save Consistently

Saving is more than putting money aside; it’s about building a safety net and preparing for future opportunities.

• Establish an emergency fund that covers three to six months of living expenses.

• Automate your savings, so money is put away before you even see it.

• Aim to save a specific percentage of your income each month.

Even small amounts add up over time, and a robust savings habit gives you the flexibility to take advantage of new opportunities without relying on debt. - Invest in Your Future

Investing is an essential step toward building wealth. Rather than letting your money sit idle, put it to work:

• Research different investment options, such as stocks, bonds, or mutual funds.

• Consider speaking to a financial advisor for personalized advice.

• Understand your risk tolerance and invest accordingly.

Smart investments can create additional income streams and secure your financial future by making your money grow over time. - Create Multiple Streams of Income

Relying solely on one income source can be risky, especially in uncertain times. Diversifying your income can help cushion against financial setbacks.

• Explore side gigs or freelance work in areas of your expertise.

• Consider passive income opportunities, like rental properties or dividend-paying stocks.

• Leverage your skills to create a small business or online venture.

Multiple income streams not only offer financial security but can also accelerate your progress toward achieving major financial goals. - Leverage Resources Wisely

Using the money of others, such as bank financing or investment packages, can help you grow your financial portfolio without shouldering the total upfront cost.

• Research options to finance business ideas or investments instead of relying solely on personal funds.

• Remember that not all debt is harmful—using debt to build income-generating assets can be a smart strategy if managed carefully.

• Avoid consumer debt and focus on investments that yield long-term rewards.

Judicious use of leverage can amplify your financial gains when executed with a clear plan and careful risk assessment. - Educate Yourself and Stay Informed

Financial literacy is a powerful tool for improving your situation. Stay updated on market trends, new investment strategies, and personal finance tips.

• Read books, attend webinars, or follow trusted financial experts.

• Participate in online communities where members share real-life strategies for success.

• Be open to learning from both your experiences and the experiences of others.

Knowledge equips you to make smarter financial decisions and empowers you to adapt to changing economic conditions.

In Summary

Enhancing your financial health is a continuous process that demands commitment, thoughtful planning, and a willingness to learn. From crafting a reliable budget and saving consistently to making smart investments and exploring multiple income streams, each effort plays a vital role. Keep in mind—achieving financial independence takes time, but with determination and informed decisions, you can pave the way toward a stable and prosperous future.

If you have additional questions or seek tailored guidance, our dedicated team of experts is ready to assist—you don’t have to navigate your financial journey alone.

Leave a Reply